This is a follow-up blog post in a deep dive series exploring how NFT projects can use NFT data analytics to supercharge their projects with actionable insights. Find part one here.

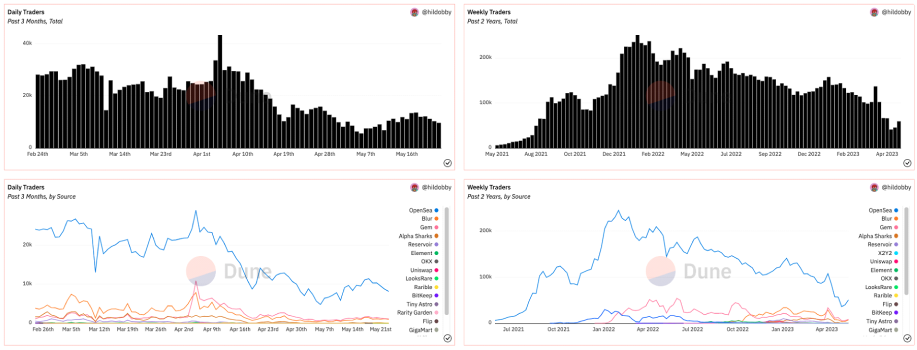

It’s no secret that Web3 has a small user base—especially relative to the billions of users that Web2 social platforms and games collectively have today. While there aren’t established metrics on the total number of NFT enthusiasts, the following Dune Analytics dashboard shows that the average range of daily to weekly NFT traders fluctuates between 10,000 – 250,000.

Daily and weekly trader counts by the marketplace. Source: Dune Analytics.

During down-market cycles such as the one we’re in today, NFT projects are largely competing for the attention of the same users. But as an NFT project, how do you employ strategies that can effectively grab the attention of another collection’s holders, and which users are best to target?

Uncovering the Relationships Between Collections

A hallmark offering of Helika’s NFT analytics platform is overlap analysis, which shows the overlap of NFT holders between different NFT collections.

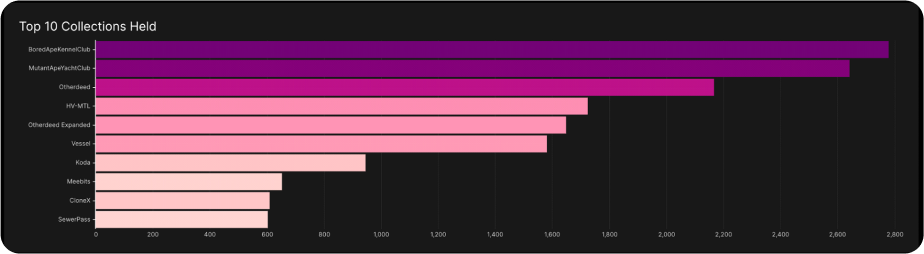

For example, an intuitive hypothesis that the Yuga Labs team may hold is that many Bored Ape Yacht Club (BAYC) holders also have related NFT collections such as Mutant Apes, Bored Ape Kennels, Koda NFTs, Otherdeeds, Sewer Passes, and more.

The top 10 collections held by BAYC holders.

This is true from the Helika Overlap Analysis chart above—BAYC holders like owning other NFTs that are part of the Otherside metaverse. However, where this data becomes even more interesting is when an NFT collection doesn’t have multiple NFT collections.

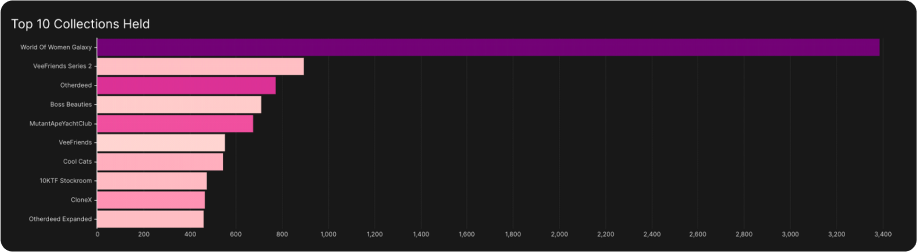

Let’s look at World of Women, which only has two NFT collections: World of Women and World of Women Galaxy.

Again, there’s a clear holder relationship between the original NFT collection (World of Women) and other collections (World of Women Galaxy) from the same project. But in this case, we can also see that there is a substantial overlap between World of Women holders and other collections, notably VeeFriends and Boss Beauties.

Takeaway: Repeating this overlap analysis for your NFT project and digging deeper into the different zonal relationships between holders of different collections can provide valuable insight into which existing NFT users might find your project the most compelling.

In the case of World of Women, external NFT projects like Boss Beauties represent a clear opportunity area for acquiring new holders. Both largely cater to women, have similar aesthetic PFP art, and are mission-focused.

It’s important to note that this doesn’t have to be a purely competitive dynamic: converting a Boss Beauties holder to World of Women doesn’t necessarily mean they’re selling one for the other. Instead, this overlap analysis provides a high-level overview of which collection audiences might be the best fit for what your project is already doing. From there, it’s a matter of digging into the initiatives and new experiences that might attract new holders from that collection while staying true to your project’s brand.

While much of this can be intuited, NFT projects can save themselves valuable time by verifying their hypotheses with the hard data provided by Helika. It’s equally as possible you’ll find something unexpected—such as the clear relationship between World of Women and VeeFriends holders.

Benchmarking Your Project

The overlap analysis provides a great starting point for further research when aiming to analyze your NFT project relative to other collections.

From the overlap analysis above, it’s clear that there’s a correlational relationship between World of Women and VeeFriends holders. Both exist within the same floor price range (0.5-2 ETH), were released at similar times, have similar NFT supplies, and largely exist outside of the crypto Twitter-sphere—though not completely.

Given this apparent holder overlap between the two projects, VeeFriends acts as a stellar candidate for World of Women to benchmark themselves against by comparing:

- Unique Holders

- Holder Retention

- Sales Volume and Royalties

Helika’s data analytics platform makes this form of competitive analytics easily accessible to any NFT project. Let’s dive in.

Note: For all of the following screenshots, World of Women is represented on the left, and VeeFriends on the right. The time horizon is 1 year.

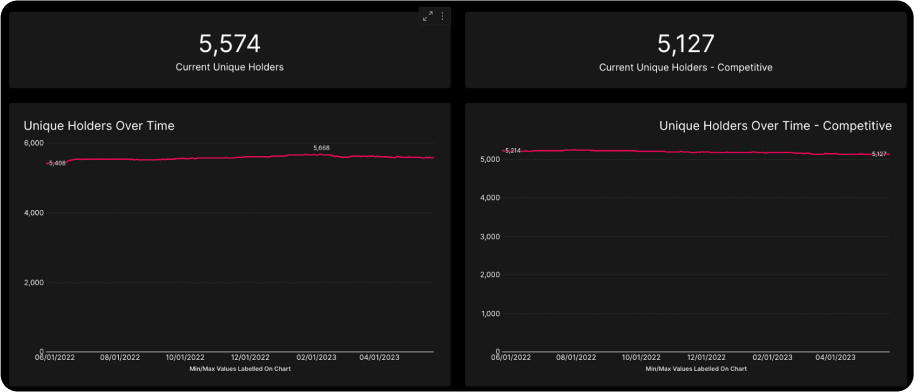

Unique Holders

The most fundamental metrics for an NFT project: Large swings in either direction mean there were monumental effects on the project.

Takeaway: In general, World of Women is trending upwards in its unique holder count, while VeeFriends is trending downward. However, the fluctuations are fairly small, with around a ~4% uptrend for World of Women and a downtrend for VeeFriends.

This suggests that on average, World of Women is passively gaining more interest while interest from new holders in VeeFriends is slightly trending down—a small point in World of Women’s favor.

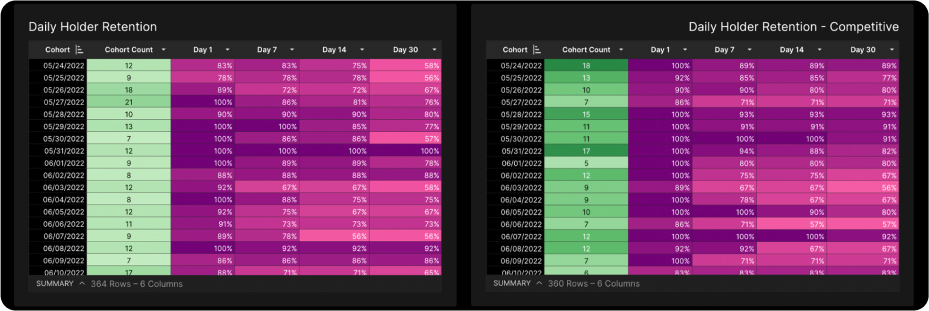

Holder Retention

Holder retention is a great metric for understanding how effectively an NFT project keeps its holders actively engaged.

Darker colors refer to higher retention rates.

Takeaway: On average, VeeFriends holders are more likely to hold onto their NFTs within a 30-day period compared to World of Women. This suggests that VeeFriend’s branding and continuous initiatives are more effective and engaging to its holders than World of Women is for its holders.

This suggests World of Women should analyze which initiatives and new developments have significantly (and positively) impacted a particular cohort’s holder retention rate to understand better what their holders want. This blog showcases how to perform this analysis.

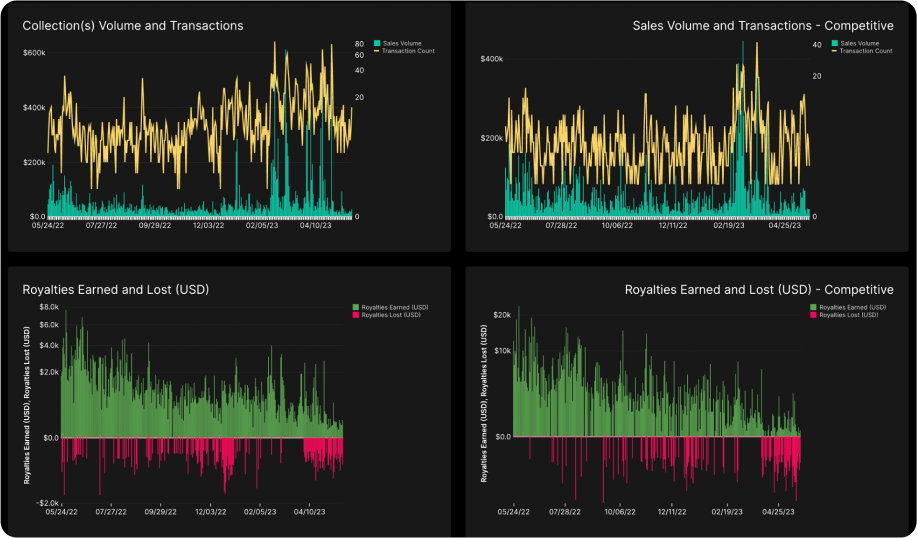

Transactions, Sales Volume, and Royalties

Transactions, sales volume, and royalties provide valuable insights into the underlying financial activity and revenue between different projects, and the differences between them, if any.

Takeaway: World of Women NFTs are, on average, more likely to be transacted compared to VeeFriends—a metric that aligns with the project’s lower holder retention. This also has resulted in a higher average sales volume for World of Women. However, VeeFriends is ~2X the royalties (10% royalties vs 4% royalties) of World of Women, even with its lower transaction count.

This data, alongside the overlap between each collection’s holders, suggests that World of Women could potentially raise its royalty rate to negligible effect. But such an initiative will also warrant a deep dive into user behavior around royalties—which you can learn how to analyze by reading this blog.

Conclusion

NFT projects don’t exist in a vacuum: market cycles, dynamics, and competitors are all critical to understanding in what area your project is succeeding, and where it needs more work.

Helika provides a simple, all-inclusive NFT data analytics platform for your project to make informed decisions—whether it’s to compare your collection to the broader market, benchmark yourself against competitors, or dive deep into holder behavior and segments.

Helika offers free trials for any NFT project. Take the guesswork out of your decision-making process by signing up today.